Pharmacy Information

Forms & Additional Information

Your HRA and FSA Benefits

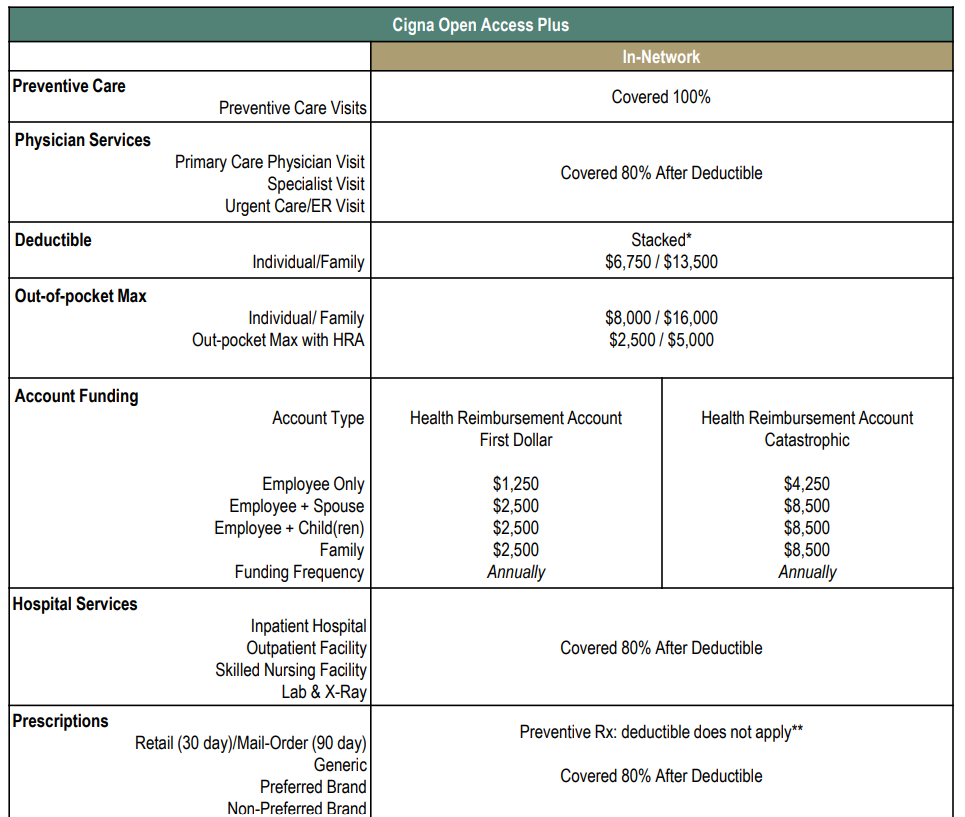

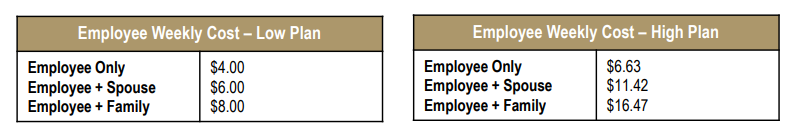

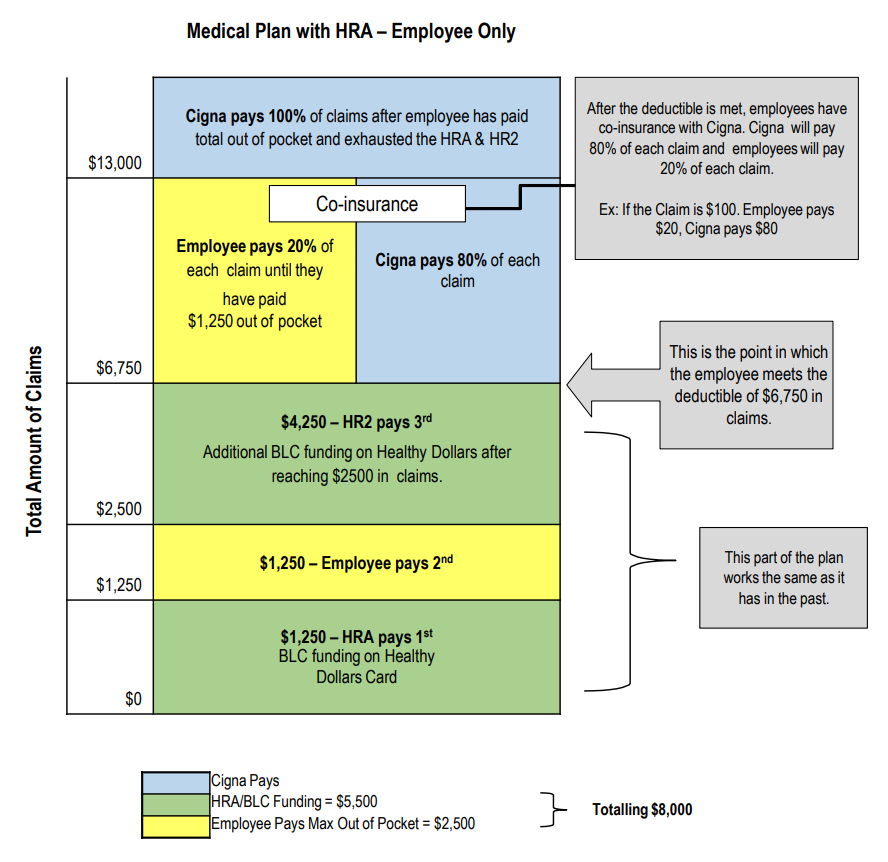

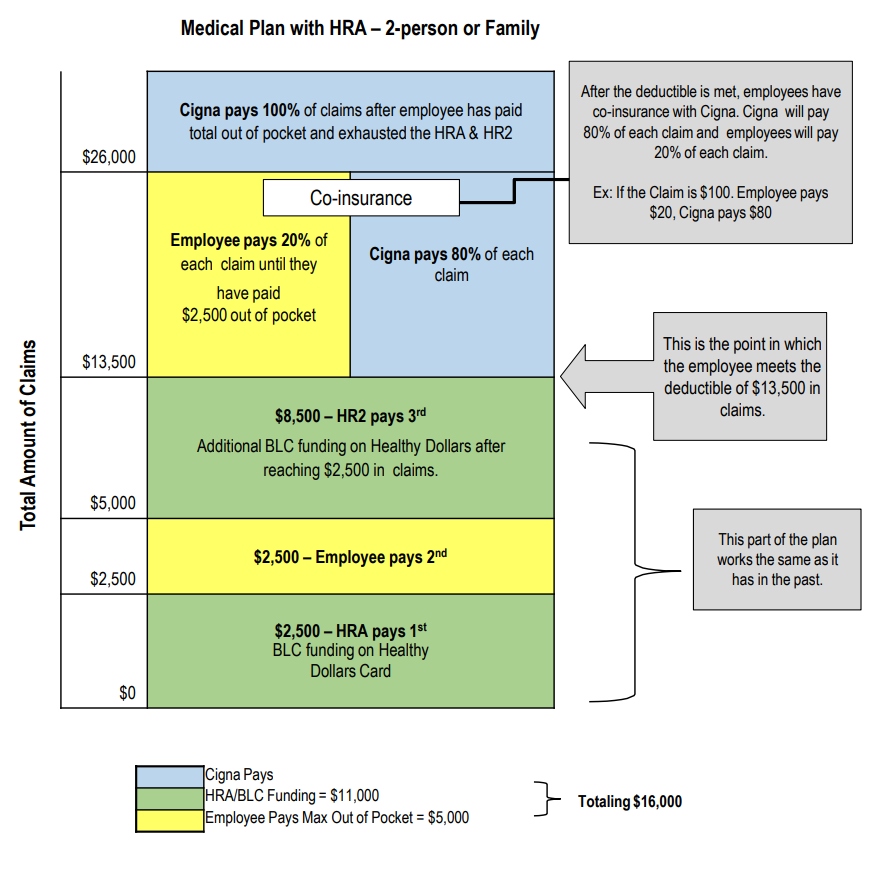

Understanding Medical Plan and HRA

In order to help employees meet their high deductibles, Bread Loaf will make a deposit into the HRA for employees on the medical plan.

An HRA is an employer funded, tax advantaged health benefit plan that reimburses employees for out-of-pocket medical expenses. Employees do not contribute to this plan. Your HRA can be used to pay for a wide range of IRS qualified medical expenses for you or your spouse and tax dependents.

Bread Loaf will contribute $5,500 for individual plans and $11,000 for family plans. The HRA pays the first portion, employees pay the second portion, and the HRA2 pays the final portion.

Eligibility

Employees who are enrolled in the Bread Loaf medical plan are automatically enrolled in the HRA plan.

Contact Us

![]()

Healthy Dollars Customer Service: 1-877-687-6921

Email: service@healthydollarsinc.com

www.healthydollarsinc.com

Forms

Your FSA Benefits

Flexible Spending Account

Flexible Spending Accounts provide you with an important tax advantage that can help you pay health care and dependent care expenses on a pre-tax basis. By anticipating your family’s health care costs for the next year and setting aside money, you can lower your taxable income.

Annual Max & Utilization:

The annual maximum amount you may contribute to this FSA is $3,300 per calendar year. The annual maximum amount you may contribute to the DCA is $5,000 per calendar year. This program allows employees to use pre-tax dollars for certain IRS-approved expenses.

Some Flexible Spending Account examples include:

- Hearing services, including hearing aids and batteries

- Vision services, including contact lenses, contact lens solution and eyeglasses

- Dental services and orthodontia

- Medical and Rx deductibles

- Reimbursable through the FSA unless you have a prescription from your physician

For a full list of eligible expenses, visit: https://healthydollarsinc.com/fsa-eligibility-list/

Eligibility

All employees may enroll and contribute to an FSA.

Contact Us

![]()

Healthy Dollars Customer Service: 1-877-687-6921

Email: service@healthydollarsinc.com

www.healthydollarsinc.com

Forms

FSA Store

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending Account.

Did you know you could use your FSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

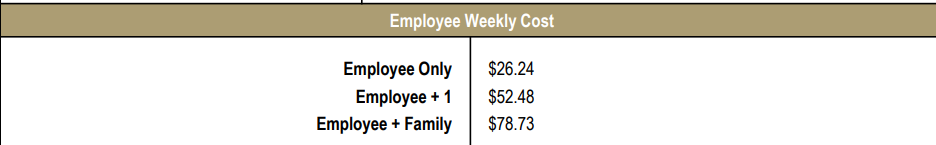

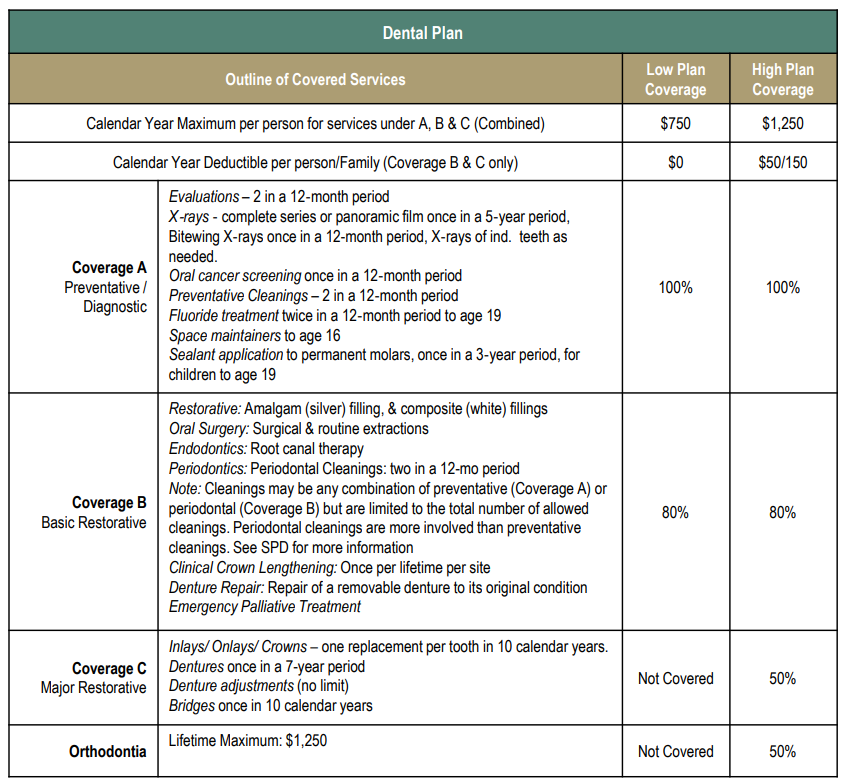

Your Dental Benefits

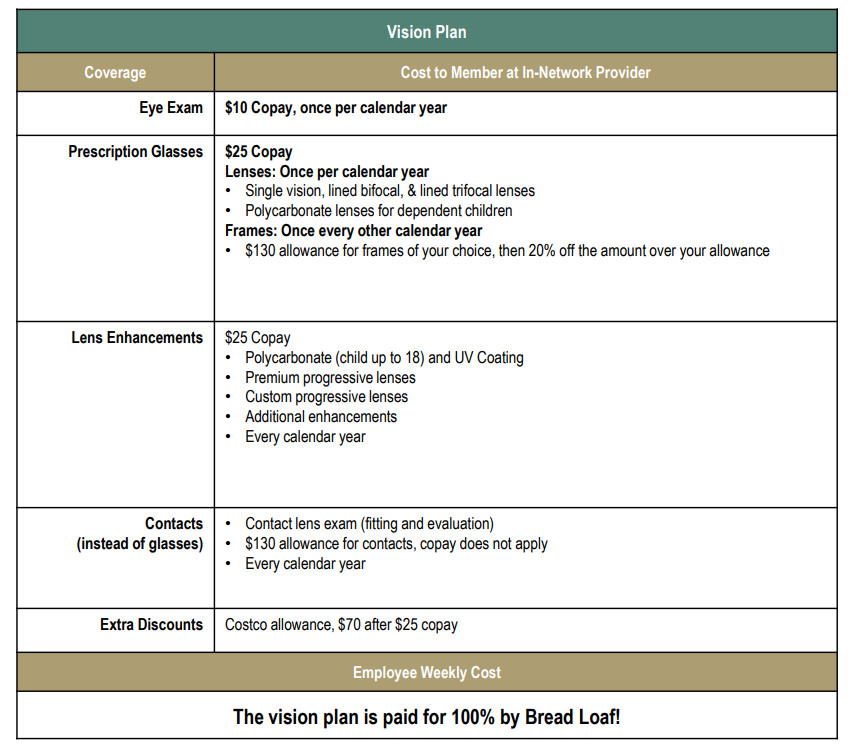

Your Vision Benefits

Your Life Insurance and AD&D Benefits

Group Life and Accidental Death and Dismemberment (AD&D)

1 times salary, rounded to the next higher $1,000, up to $200,000.

Basic Life/AD&D Insurance

Life Insurance provides your named beneficiary(ies) with a benefit in the event of your death. Accidental Death and Dismemberment (AD&D) Insurance provides specified benefits to you in the event of a covered accidental bodily injury that directly causes dismemberment (i.e., the loss of a hand, foot, or eye). If your death occurs due to a covered accident, both the Life and the AD&D benefit would be payable. Basic Life/AD&D Insurance is provided at NO COST to eligible employees.

Benefit Amount

- Basic Life and AD&D Benefit amount: 1x annual salary – $200,000 maximum.

- Benefits reduce by 50% @ age 70.

Supplemental Life Insurance

If you determine you need more than the Company-paid Basic Life coverage, you may purchase additional coverage for yourself and your eligible family members. The maximum insured age for employees and spouses is 75.

Benefit Amount

- Employee and Spouse: choice of coverage from $10k – $500K, in increments of $10k.

- Dependent Children:

- 14 days – 6 months: $1k flat amount.

- 6 months – 25 years: Choice of $2,500 – $10k, in increments of $2,500.

Guaranteed Issue Amount

- Employee: Under age 70: $70k; Age 70+: $0.

- Spouse: Under age 60: $10k; Age 60+: $0.

- Dependent Children: all benefit amounts

Voluntary Life and Dependent Life Insurance

Employee and Spouse: $10,000 to $500,000 in $10,000 increments.

Dependent Children: 14 days to 6 months – $1,000 flat benefit amount

Dependent Children: 6 months to 25 years – Choice of $2,500, $5,000, $7,500, or $10,000 (one benefit amount and one rate for all eligible children in family)

|

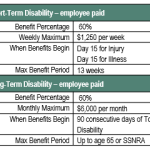

Your Disability Benefits

Disability Insurance

Voluntary Short-term and Long-Term disability Insurance is offered to you through Reliance Standard. Disability insurance provides benefits that replace part of your lost income when you become unable to work due to a covered injury or illness.

Voluntary Long Term Disability

Long Term Disability insurance protects an employee from loss of monthly income in the event that he or she is unable to work due to illness, injury, or accident for a long period of time.

Voluntary Short Term Disability

Short Term Disability insurance pays a percentage of your weekly salary if you become temporarily disabled and you are not able to work for a short of time due to sickness or injury.

Included Benefits

Forms

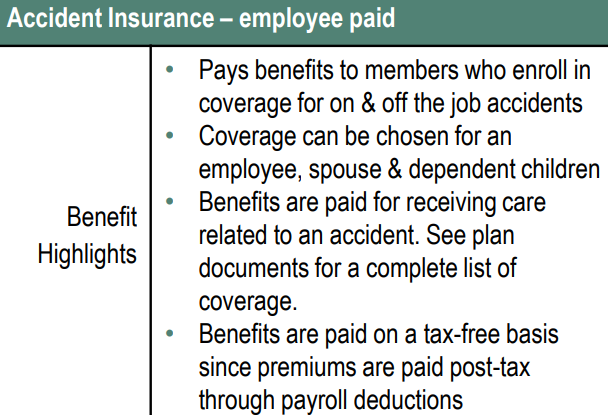

Your Voluntary Accident Benefits

Accident & Critical Illness Insurance

Accident and Critical Illness Insurance is offered to you through Reliance Standard. Accident insurance provides benefits to employees who incur medical expenses resulting from an accident. Critical Illness Insurance pays benefits should a member develop a critical illness.

Your Critical Illness Benefits

Voluntary Critical Illness

Reliance Standard’s Voluntary Group Critical Illness insurance provides a fixed, lump-sum benefit when critical illness strikes. This includes heart attack, stroke, paralysis and more.

Your Retirement Benefits

Eligibility

You are eligible if you are 19 year of age or older.

Entry Dates

January 1, April 1, July 1, or October 1 following completion of the above-listed requirements.

Employee Contributions

Eligible employees may defer up to 100% of their gross wages into the Plan on a pre-tax basis to a regular 401(k) account by pre-tax or ROTH contributions. Participant’s deferrals cannot exceed the maximum allowable dollar amount per year – ($23,500 for 2025). This level is set by the IRS and is subject to change. Please note, catch-up contributions for employees 50 and older is $7,500.

- Pre-Tax Contributions: Reduces your current adjusted gross income

- ROTH Contributions: Made with after-tax dollars

Employer Contributions

Bread Loaf Corporation may make discretionary matching contributions to the Plan. The amount will be determined each year by the employer on a uniform basis for all employees. Bread Loaf Corporation may make a discretionary profit-sharing contribution determined each year. Participants are eligible to receive profit sharing contribution if they are employed on the last day of the plan year.

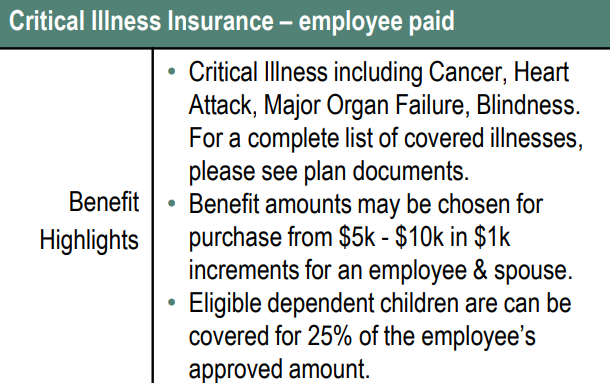

Vesting

The employee deferral contributions are 100% vested at all times. You will be vested in Employer contributions and any earnings on those contributions according to the following schedule:

Investment Options

Plan participants may elect to invest their Plan assets among a list of available investment options. Information has been provided for each of the investments available, in your Enrollment Kit set forth in the quarterly fund fact sheets.

Contacts

https://secure.ascensus.com/login/Participant

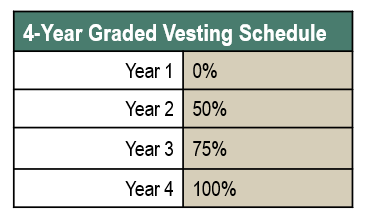

SmartConnect - Medicare Resource

SmartConnect through The Richards Group

Medicare is very complex, and it is important that you have an advocate who can provide you the proper Medicare education and guidance.

There are different paths you can choose in Medicare plans, and it can be very time consuming and difficult to filter through these options yourself. It is important that you find the appropriate plan in your area that best fits your medical needs and is within your financial budget.

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults (employees are eligible to enroll 3 months before they turn 65) to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

For more information or to get started, please click on the following link:

SmartMatch Insurance

1-833-502-2747 | TTY: 711

Additional Information

Student Loan Repayment

Eligibility

In order to participate in the plan, you must satisfy certain age and service conditions under the plan:

1. Minimum age requirement: In order to participate in the plan, you must be at age 21.

GradFin – Student Loan Assistance

The Bread Loaf Student Loan Assistance program is designed to help employees pay back student loan debt and improve their financial well-being. Utilizing Bread Loaf’s relationship with our broker, The Richard’s Group, consultation services provided through GradFin are provided FREE OF CHARGE.

GradFin will:

- Provide one-on-one education with expert to review your current loan status and discuss payoff options.

- Offer a competitive interest rate reduction when you refinance your loans.

- Offer the lowest interest rates in the industry through their lending platform

Contact Us

|

For more information or to schedule a 15-minute appointment with a GradFin Consultation Expert click HERE! Phone: (844) GRADFIN Or call 610.639.7840

|

Employee Assistance Program

BreadLoaf offers an Employee Assistance and Mental Health Program to all employees and household members – free of charge! BreadLoaf understands how work and personal challenges can affect your health and well-being. At some point in our lives, we could all use a little extra help. InvestEAP is available 24 hours a day, 365 days a year. Create a login with your organization’s password: breadloaf

Employees and household members can access a counselor, conveniently located near their home or workplace. Up to 5 face-to-face sessions per year, per individual occurrence, at no cost.